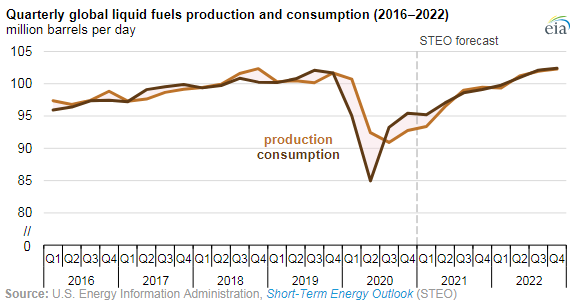

Recently, EIA predicts in its March Short-Term Energy Outlook that oil price is going to rise in the second quarter of 2021 due to less oil production by OPEC countries.

On March 4, the 14th Meeting of OPEC and non-OPEC Ministers was held via video conference, where participating ministers agreed to adjust downwards crude oil production. During the meeting, the ministers extended special gratitude to Saudi Arabia for the extra supply reduction, which is of great importance for rebalancing the global oil market.

Early in February, OPEC+ (OPEC partner countries) started the cuts. Together with the supply disruptions in the United States, they contributed to the monthly global petroleum inventory withdrawals that EIA estimates totaled 3.7 million b/d, which is the largest monthly withdrawal since December 2002.

The Brent crude oil futures price averaged $63/b in early March, which had led to the OPEC+ meeting. Apparently, the results of the meeting only laid further upward pressure on crude oil prices.

The OPEC+ production reduction is going to sustain throughout April and it manifests that supply will remain constrained in the near term in spite of the fact that market demand will continue to increase.

As a result, EIA estimates that further inventory withdrawals will continue to meet rising crude oil demand, thus keeping crude oil prices elevated through at least the end of April.

With that being said, EIA’s forecast of downward oil price pressure and increased crude oil availability has several key uncertainties.

The foremost factor would be the speed of actual demand recovery. It is based on how fast the global market would recover from COVID-19. Some vital data to look at includes vaccination rates and the degree to which travel and employment conditions can return to pre-COVID norms. It remains a major uncertainty on the demand side.

At the same time, the degree to which OPEC+ production cuts will continue after April acts as a source of uncertainty on the supply side. In light of the fact that increasing crude oil prices will encourage OPEC+ participants’ tendency to increase production in later meetings, or to relax compliance with the existing agreement to a certain extent.

Time is key. It is essential to keep up with the pace and to take the lead when it’s time to pile up production.

As a leading oil & gas solution provider in the world, Jereh is committed to providing customized and competitive equipment and solutions to help client enhance efficiency while maintaining a reasonable overall cost, by virtue of its competitive and customized completion & stimulation equipment.

For example, in June 2020 the new generation 7000hp electric frac pumper went offline and passed factory test in Yantai, China. The product owns the biggest power within China, which is up to 7000hp, 3 times of regular 2500hp diesel frac unit. In the meanwhile, the power density of electric frac pumper is up to 134kW/t, the largest in the world and more than twice that of conventional diesel drive counterparts.

This means it only takes 9 electric fracturing units now to accomplish the same amount of work that required 18 sets of diesel-driven fracturing equipment in the past. As thus, the operation needs not only less space for operation, but also less cost for purchasing and maintenance.

Since last year, Jereh 10,000hp electric fracturing trailer and 5000hp electric fracturing skid have started to participate in key shale oil projects in China, helping to accomplish maximum fracking, 11 sections a day in Bohai Bay.

As for cementing equipment, Jereh draws on previous experience and independently developed world's first dual-mixing cementing unit. Featuring large displacement and high power, it has the max. slurry mixing capacity of beyond 3.0 m³/min, setting a new world record for single-tank cementing unit.

It was common sense that single pump cementing unit, twin pump cementing unit or quintuplex pumper fail to satisfy current operation just by one unit. It sometimes takes 6 units to run simultaneously for a large-displacement operation, demanding rather high money and manpower input.

The new equipment is equipped with Jereh-developed AMS 4.1 automatic mixing system, with max. slurry mixing capacity surpassing 3.0m³/min while the density reached 1.83g/cm³.

In the field of coiled tubing, Jereh also stands out from its competitors. In recent years, China's largest coiled tubing unit developed by Jereh was delivered to North America, which has the longest coiled tubing string and largest diameter, aiming at making local oil & gas operation more efficient and safer.

By adopting Jereh 140K injector and latest super large reel, over 7,560 meters of coiled tubing (2.625’’) can be wound on the reel. Meanwhile, a special chassis was used to carry coiled tubing up to 57 tons, suitable for operations like large-displacement fracturing and coiled tubing drilling.

Facing versatile oil price and market need, Jereh shall respond to all changes with constant innovation and keep pursuing better technologies to deliver a step-change in raising operation efficiency and help global clients to overcome the hard times side by side.

For more information please visit: https://www.jereh.com