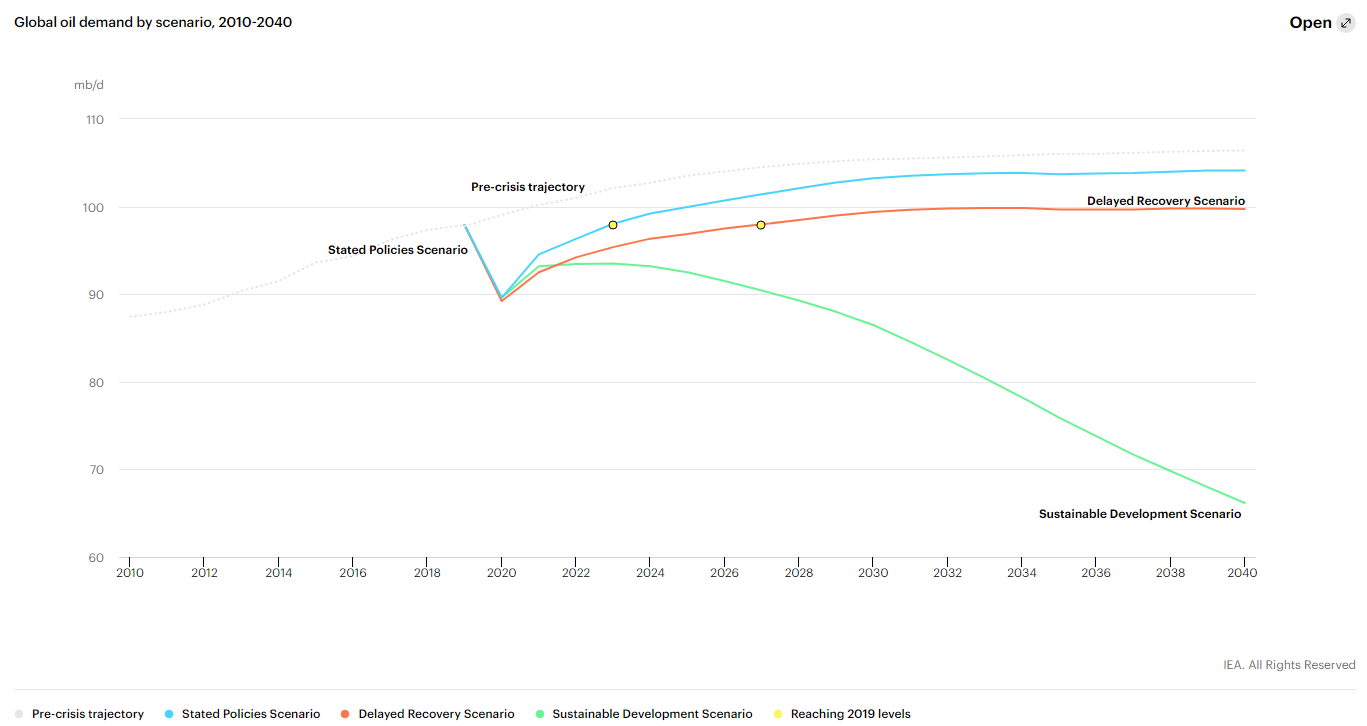

Before the pandemic hit the market bad in 2020, there was some predictions already believing that the growth of global oil demand would end within 10 years. And it seemed that the situation has stepped on a fast lane after the economy and oil demand dive down to a bottom, when Covid-19 swept in at the beginning of the year.

Declined oil prices and downward revisions to demand, led by the pandemic, have cut about one-quarter off the value of future oil and gas production. So far in 2020, leading oil and gas companies have lowered the reported worth of their assets by more than $50 billion, explicitly expressing their lack of confidence when facing an uncertain future. Also, investment in oil and gas supply has also been reduced by one-third compared with that of 2019.

And yet, IEA reveals in its latest outlook for world energy that it is still too soon to forecast a rapid oil demand decline in the near future.

The speed of the economic recovery is a key uncertainty that influences oil demand. On one hand, there surely are some changes of people’s daily behavior that could eat into oil consumption, such as working from home or banning air travel. However on the other hand, not all the shifted behavior will disadvantage oil demand.

Private transport, for instance, benefits a lot under such circumstances, leading to the continued popularity of SUVs and the delayed replacement of older, fossil fuel vehicles.

Although fuel efficiency is improving and the sales of electric vehicles is booming, the oil use for transport will peak in recent years before it witnesses a slight downhill in 5 to 10 years.

With that being said, transport fuel is not the only main support for demand growth. There are other factors are backing the oil demand, too. Who takes the most share among all these factors? The answer lies in the south and east of Asia.

With all the emerging markets and developing economies, Asia is in fact creating strong underlying demand for energy, mainly fossil fuels, which could offset a decent deal of reductions in oil demand elsewhere. Among all the demand, the emerging markets are dealing with the challenges of furthering infrastructure construction and growing manufacturing industry. Thus, a huge demand-supply gap will probably continue to exist for a period of time. And the quicker regional economy recovers, the quicker energy demand will kick back.

As for natural gas, it is likely to fare better than other fossil fuels, but the performance may vary under policy contexts, according to the forecast of IEA. In the case that stated energy policies are fully implemented, there will be a 30% rise in global natural gas demand by 2040 in South and East Asia. Countries in these regions have decided to put air quality and environment protection as priorities in the coming years. Shifting to the clean, affordable and efficient natural gas could be a top option on the list. For most carbon-intensive economies, natural gas keeps growing because of their lower emissions, especially when compared with coal and oil.

As for countries who have set net-zero emission goals, converting to natural gas is an important pathway to achieve that and in fact many of them have accomplished a great number of coal replacement of different applications. In Europe under the stated emission policy scenario, greater transparency on emissions seems to be on the way for many countries, a rising share of natural gas is foreseeable. The challenge for them is to retool natural gas for this different energy future, which could include enhancing carbon capture, improving utilization and storage and so forth.

On the contrary, if a portion of the above countries fail to fulfill their promises on emission goals, the actual situation could be slightly different with no doubt.

Keeping an eye on the demand fluctuations, getting yourself armed with the most competitive equipment and technology are two key strategies that help you always get ready for market demand.

As a leading oil & gas solution provider in the world, Jereh is committed to arming our clients with competitive equipment and solutions and help them enhance efficiency as well as maintain an economical overall cost.

Leveraging strong R&D capability and rich experience, Jereh has proved its capabilities and thus earning trust from global customers.

Jereh’s series of completion & stimulation equipment cover cementing fleet, frac spread, coiled tubing fleet, nitrogen pumping units and so forth, applicable for different well sites with various operation conditions.

At the same time, Jereh is also specialized in project design, development and equipment manufacturing for gas boosting, gas treatment, natural gas fueling, de-carbonization, acid gas removal, dehydration and etc., dedicated to reducing carbon emission, benefiting energy conservation and reducing footprints on nature to the least.

For more information please visit: https://www.jereh.com